how to set up a payment plan for california state taxes

How to Request a. The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted.

Buy Now Pay Later Pay In 4 Or Pay Monthly Options Paypal Us

The IRS offers several payment plans for taxpayers depending on the amount of.

. To make periodic payments you will need to set up an account. County of Los Angeles Treasurer and Tax Collector. Pay by automatic withdrawal from my bank account.

Sign in to the Community or Sign in to TurboTax and start working on your taxes. You may mail your completed application and payment to the address below. Individual taxpayers need to pay a 34.

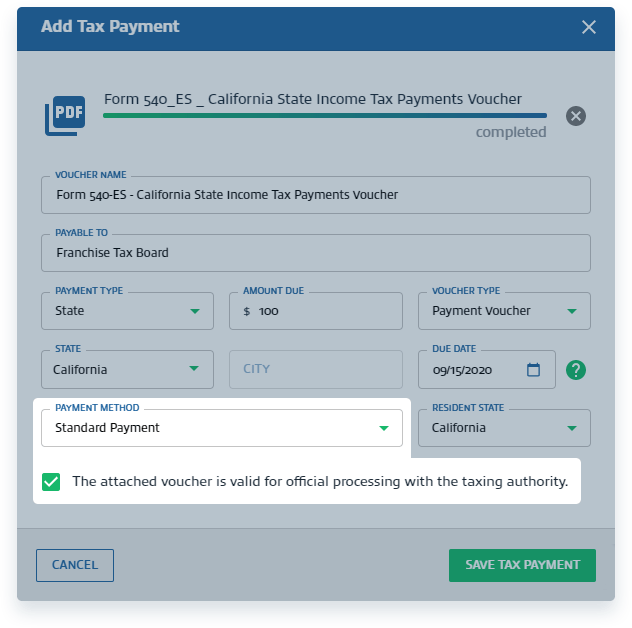

Individual taxpayers who owe up to 25000 to the California FTB Franchise Tax Board can pay in monthly installments for up. Processing the application takes 90 days and costs 34 for individuals and 50 for businesses. Why sign in to the Community.

As an individual youll need to. Typically taxpayers are given three to five years by the state to pay off a balance once a California tax payment plan has been granted. Individual taxpayers and businesses can apply for instalment plan agreements from the FTB.

If you are looking to set up a payment plan that is less than 12 months in length and you owe less than 50000 you have a few options. You will also need to set up a My Tax account if you want to request a Wisconsin tax payment plan online. Pay a 34 set-up fee that the FTB adds to the balance due.

Offers in compromise OIC IRS Payment Plans for Individuals and Businesses. It may take up to 60 days to process your request. Make monthly payments until my tax bill is paid in full.

Post Office Box 512102. The State of California has provided access to payment plans. The taxpayer must agree to the following Taxpayer Installment Agreement Conditions while in an Installment Agreement.

Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. Keep enough money in. Pay a 34 setup fee that will be added to my balance due.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

Understanding Payroll Tax Payment And Filing Requirements Wolters Kluwer

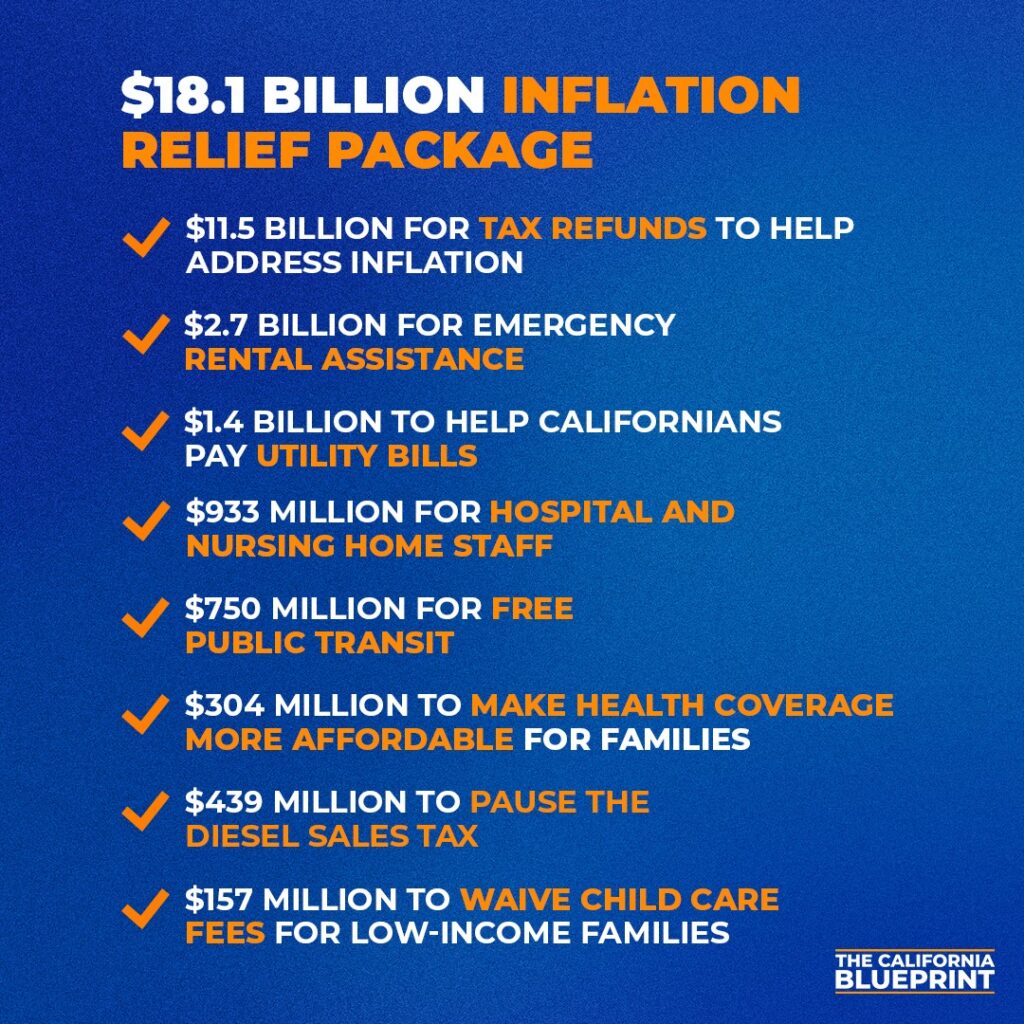

California Stimulus Check When To Expect Inflation Relief Payments

Cavuto Presses California Assemblyman Over Wealth Tax Plan Amid Millionaire Jailbreak From Golden State Fox Business

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Tax Payment Plans What To Know If You Can T Pay Your Taxes

California Tax Rates H R Block

When Is The California Llc Tax Due Date 2022 Guide

State Accepts Payment Plan In San Jose Ca 20 20 Tax Resolution

Politifact 50 Cent S Upset With Biden S Tax Plan What Does It Mean For The Rest Of Us

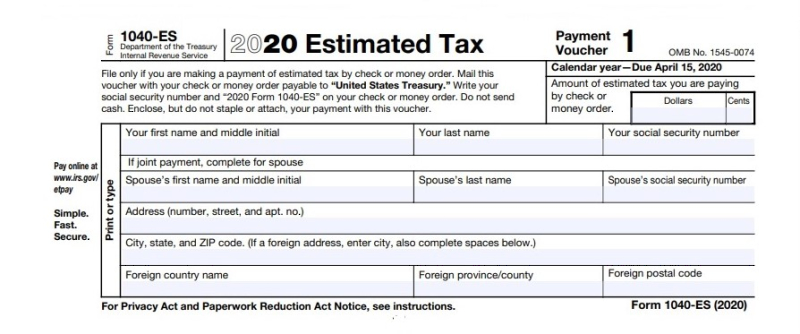

Making Electronic Estimated Tax Payments In California Robert Hall Associates

Important Information Regarding California State Tax Withholding

Student Financial Services Csu Chico Media

California Sees Warning Sign From Weak Tax Revenue Collections Bloomberg

California Gas Refund The Inflation Relief Starts October The Sacramento Bee

New California Alaska Airlines Mileage Plan Members Get A Free Flight Up To 25 000 Loyaltylobby

The Open Secret About California Taxes Calmatters

State Accepts Payment Plan In Marina Del Rey Ca 20 20 Tax Resolution